Carlos Catalán, UBS expert in the validation of market risk models, teaches a seminar in the second year of the master's degree, which consists of two blocks.

Block I: Types of interest. Subjacent valuation and construction.

In this block students learn:

1) How to value linear and optional market products (real cases).

2) Subjacent constructions for the valuation of financial instruments (corbels, volatility surfaces, ...).

The focus is on interest rates, but a very similar procedure is applied to other types of risk, such as FX, EQ, CM, CR. The main characteristics of each risk class are detailed.

Students will learn how to build a financial instrument valuation tool/prototype in *Python.

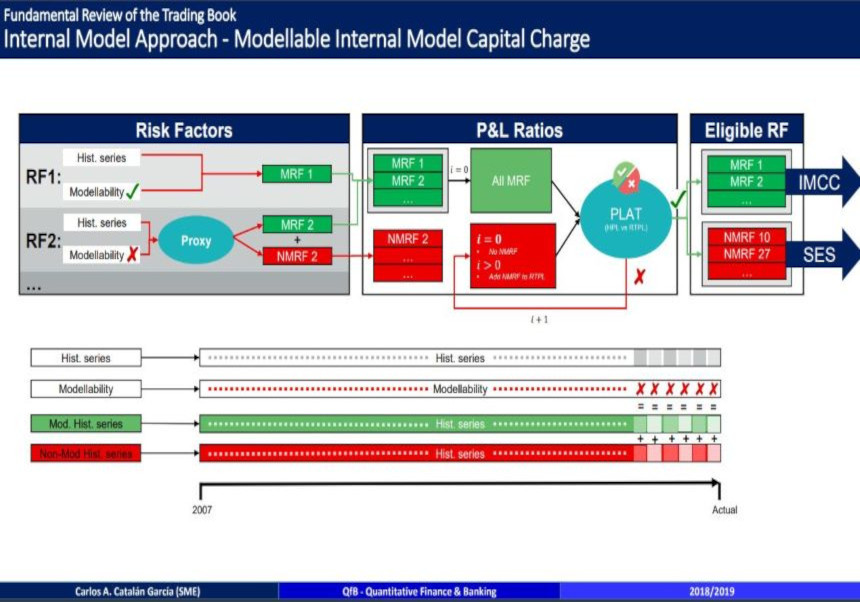

Block II: Market Risk - FRTB.

In this part of the seminar students learn concepts introduced in FRTB and capital calculation under the new Basel regulation. This block consists of two parts:

1) Capital calculation under the standard model.

2) Capital calculation under the advanced model.