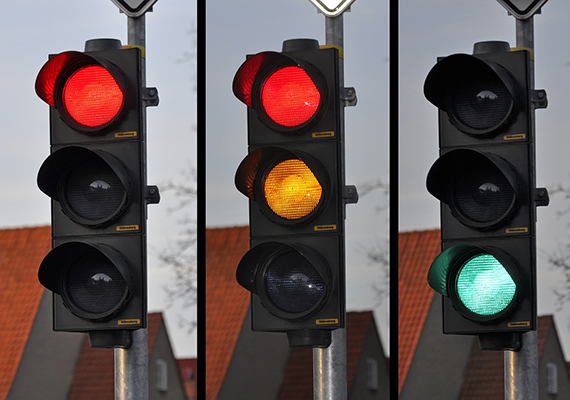

Between the Defensor del Pueblo, the Stock Market National Committee and the Ministry of Economics, a new information system for retail investors has been brewing since 2012. Here we analyse the new “risk traffic light”, an initiative that on February 5th finally turned green.

5 february 2016

Three years ago the ‘Defensor del Pueblo’ underlined the need to provide more protection for retail investors, after the ‘Preferreds’ debacle. To offer the maximum information on risk, in the most simplified manner possible: “a plain and clear indicator system, which allows for the differentiation of products following their risk and complexity, without the need for technical knowledge”.

On November 5th, the official gazette for the Government of Spain (BOE) picked up the initiative that the Ministry of Economics finally decided to proceed with: the “Risk Traffic Light”. Today, February 5th, the day this system comes into effect, we decipher five key aspects of this law:

1. Five strips to measure liquidity risk…

The ‘stoplight’ introduced works in the following way. Investment risk is established with one of six segments assorted chromatically (with RGB parameters strictly under control) or by a number (from 1 to 6, 1 indicating the lowest risk and 6 the highest). In reality, an alternative, two-bar division may be defined: products for which the return of capital is completely or nearly guaranteed, with an issuer whose credit rating qualifies as level 1 or 2 (depending on the offered security); and those that don’t fulfil these requirements.

In this first group fit in five of the six colours selected by the Ministry of Economics, from deep green to orange (or 1 to 5). All these segments assure full return of the invested capital (except class 5, in which financial instruments “that guarantee the return of at least 90% of the invested funds, with a residual term equal or inferior to 3 years” are also included), so each one is characterised by its respective liquidity risk. Possible loss of capital is not the only risk taken into account, but also how inaccessible it is.

The division remains this way:

- Bank deposits and Savings-linked insurances.

- 100% Return guaranteed, under or equal to 3 years, rating level 1 (BBB+ or higher)

- 100% Return guaranteed, 3 to 5 years, rating level 2 (-BBB to BBB) or higher.

- 100% Return guaranteed, 5 to 10 years, rating level 2 or higher.

- A) 100% Return guaranteed, over 10 years, rating level 2 or higher. B) At least 90% Return guaranteed, under or equal to 3 years, rating level 2 or higher.

2. And a “Catch-all” class for the rest

The danger of class 6, emphasised by a sharp blend of red, is losing the invested funds. Whatever the unguaranteed percentage is (the aforementioned exception not included). Securities (or issuers) with a credit rating considered to be “speculative” are likewise included (it’s taken for granted that returns are not guaranteed).

Suddenly, a huge part of all available financial instruments fall into this last category. Any shares, for example, as well as the infamous ‘Preferreds’. A wide and vastly different array: from investments that guarantee a large part of the initial funds (such as the “Planes de Ahorro 5”, which ensure the return of 85%) to those in which everything could, in theory, be lost. For the Ministry of Economics, they deserve the same treatment.

3. There are more indicators

Not all the information will fall on the ‘traffic lights’: issuing entities are now obliged to indicate any other elements deemed to be dangerous for investors. Hidden clauses and small prints of the past must be reproduced in a clear way, following a series of assertions that stipulate the kind of liquidity offered, when are full returns guaranteed (only at maturity?), or if early devolutions are punished.

On another note, some financial instruments must carry an additional warning: an exclamation point, bearing the phrase “This financial product is not simple and may be hard to understand”. What are complex products? Those determined by the Stock Market Law.

4. It won’t affect all financial products

Despite the fact that the Ministry of Economics relieved the CNMV of its duties in the preparation of this system, so that financial instruments not controlled by this organisation would also be included, ultimately a large segment of products will not be obliged to follow the now-prevailing norm. For one, all public debt securities, whether national, regional, local or issued from any country member of the European Union, are understood as not needing any further protection. This means, for example, that Greek long-term bonds which Moody’s currently rates as Caa3 – junk bonds – won’t carry any indications.

Moreover, the most speculative and probably dangerous products for retail investors are not contemplated in the new legislation either. PRIIPs will have their own European regulatory frame starting on December 31st 2016, and including them provisionally in this law wasn’t deemed to be necessary. Same goes for hedge-funds or ‘Sicavs’, which have other systems (considered to be incomplete or confusing by some experts). Pension funds are partially contemplated, but will not include the chromatic scale.

5. Mixed satisfaction for the end result

The CNMV’s project has suffered several modifications on its way to official legislation. First off, two segments of the chromatic scale have disappeared (the first stoplight had eight, separated in five classes/colours), along with several products. So has the assertion “Particularly complex instrument, purchase not considered adequate for non-professional investors”. From the draft manufactured in September 2014 to the final version remains a “rather watered-down” law, says Germán Guevara, secretary of EFPA Europe.

Facua-Consumers in Action believe that th65e implemented method is still very complex, and that with the information it provides “other questions, such as acquisition terms, do not need to be clarified”. But the Defensor del Pueblo did celebrate last November the implementation of the law that the same organisation suggested in 2012. With the law in place, whether it will be enough to protect inexperienced investors remains to be seen.

Source: