Vicente Esteve teaches the subject of Economic Environment on the Master's Degree in Corporate Finance. He is Professor of Economics at the Universitat de València and associate researcher at the University Institute of Economic and Social Analysis at the University of Alcalá.

Visit his blog at http://vicenteesteve.blogspot.com/

14 may 2020

A recent study by the Federal Reserve Bank of New York quantifies the incidence of COVID-19 on US imports from China. Three relevant conclusions can be drawn from this study.

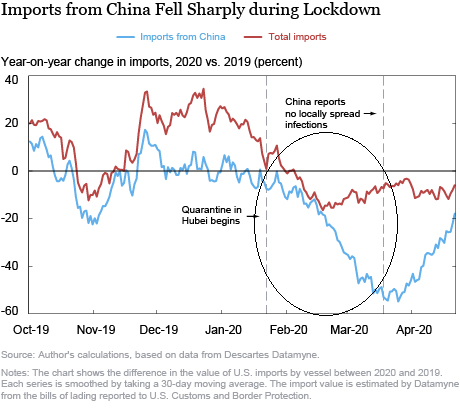

Firstly, as can be seen in the graph below, imports from China (blue line) decreased dramatically in the first quarter of 2020, while US imports in general decreased to a lesser extent (red line).

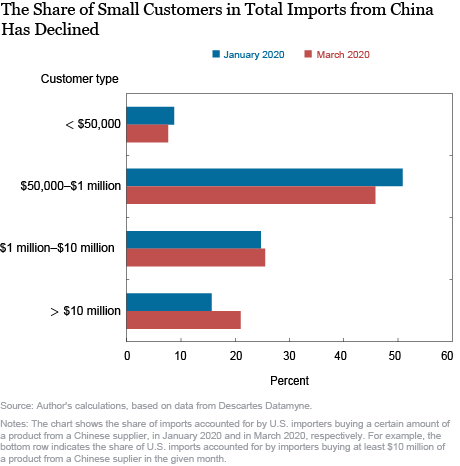

Secondly, it is interesting to see the behaviour of US companies importing Chinese products by the value of their imports (size of the order to China). As can be seen from the graph below, while most large US customers continued to trade with their Chinese suppliers, smaller customers appear to have had more difficulty in continuing their trade relations with Chinese suppliers after the start of the restrictive measures adopted in China in relation to COVID-19.

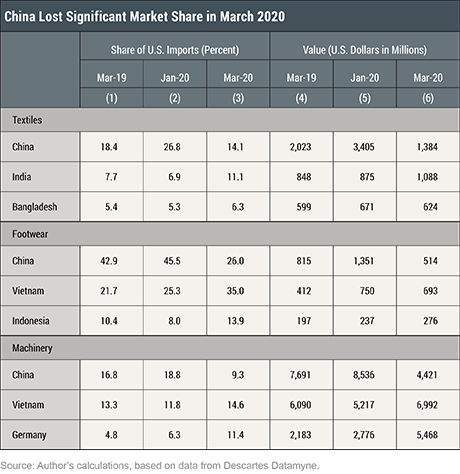

Thirdly, as the figures in the table below show, there is "trade diversion" of US imports from Chinese suppliers to suppliers in other Asian countries caused by COVID-19. [1]

The fall in imports from China has created a major shift in the supply of US companies to other countries for several product categories. The first three columns of the table record the share of US imports from different countries (including China) in March 2019, June 2020 and March 2020 (at the height of the COVID-19). The following three columns show the same information, but using the share in value.

Highlight some signs of "trade diversion".

On the one hand, China's % market share of US imports in the textile, footwear and machinery (or capital goods) sectors decreased significantly in March 2020, both compared to March 2019 and compared to January 2019.

On the other hand, the % of the market share of the textile sector originating from Indian and Bangladeshi suppliers increased very significantly. At the same time, Vietnam gained market share in the shoe sector and in the machinery sector, and Germany in the machinery sector. And these market share gains are not only in relative terms (first 3 columns) but also in terms of the value of imports (last 3 columns).

---------

[1] We have already had occasion to show another "trade diversion" effect of US imports from Chinese suppliers to suppliers in other Asian countries caused by the new US tariffs on China and the trade war:

Vicente Esteve, “Los nuevos aranceles de EE.UU. a China genera una desviación de comercio de las importaciones chinas”, Blog Viaje al Fondo de las Finanzas Internacionales, 20/2/2020, http://vicenteesteve.blogspot.com/2020/02/los-nuevos-aranceles-de-eeuu-china.html.