Vicente Esteve teaches the subject of Economic Environment on the Master's Degree in Corporate Finance. He is Professor of Economics at the Universitat de València and associate researcher at the University Institute of Economic and Social Analysis at the University of Alcalá.

Visit his blog at http://vicenteesteve.blogspot.com/

19 december 2020

A “cryptocurrency”, also known as “crypto”, is a digital currency created by a computer code and it is demanded as an alternative financial asset. Similarly, a cryptocurrency is a data chain indicating a unit. The main difference between the latter and conventional currencies is that cryptocurrencies are completely decentralised, that is, they aren’t controlled nor supervised by any government or central bank, but are monitored by a P2P Internet protocol and are valid thanks to the credibility maintained by investors.

Their price varies daily based on supply and demand like any other financial asset, just as they can be a traditional currency on the foreign exchange market (for example, the change from dollar to euro) or a share in the stock market (for example, Amazon’s quote).

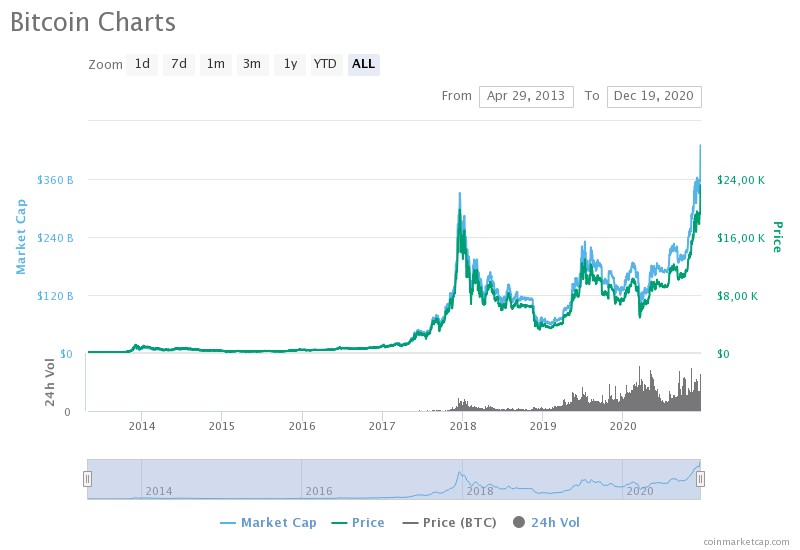

In the following graphs we show the historical evolution of prices (right scale) of the three main cryptocurrencies by market capitalisation (market cap, left scale): bitcoin, Ether and XRP.

Bitcoin is the first decentralised cryptocurrency originally introduced in a 2008 technical document by an individual or group of individuals using the alias Satoshi Nakamoto. It was launched shortly after, in January 2009. As of 2020 the true identity of the person or organisation behind that alias is still unknown.

Bitcoin’s price reached 22,912 dollars on 19th December 2020 and its market capitalisation 426,849 million dollars.

Ethereum is a decentralised chain system of open code blocks that features its own cryptocurrency: Ether. ETH functions as a platform for many other cryptocurrencies, as well as for the realisation of decentralised intelligent contracts. Ethereum has a total of eight co-founders, being the russian-canadian Vitalik Buterin the best-known of the group.

XRP is a cryptocurrency used on an e-payment platform by the name of RippleNet. The idea behind this payment platform first appeared in 2004 and was fomented by Ryan Fugger. Posteriorly, Ed McCaleb and Chris Larson took over the project in 2012 before starting their practical journey.

XRP’s price reached 0,57 dollars on 19th December 2020 and its market capitalisation 26,200 million dollars.

The risks of operating with cryptocurrency are mainly related to the volatility of the cryptocurrency market.

Going into more detail, the most common risks associated with a cryptocurrency are four: a) the volatility of its price: the unexpected changes in market expectations can create sudden and overwhelming price fluctuations; b) the lack of national and international regularisation: cryptocurrencies aren’t currently regularised by governments nor by central banks; c) there’s a potential risk of human mistakes and computer attacks; d) they can be affected by interruptions or forks. Hard forks can cause the prices to be very volatile and operations may be suspended with no prior notice if there are no reliable prices in the underlying market.

The boom of the cryptocurrency market made governments and central banks nervous. Europe doesn’t want to stay behind in the race for digital currencies, and the US Federal Reserve as well as the Central Bank of China are already trying to run in it.

The European Central Bank (ECB) published a report on October 2nd 2020 assuring that it’s starting to consider the possibility of creating a digital euro. Contrary to cryptocurrencies like Bitcoin, the digital euro will have a fixed value. The ECB believes that it should be the only issuer of a possible digital euro as it is for physical euros. It would be an anonymous payment in any case, just as if one were paying with euro banknotes.

A digital euro may avoid an e-payment service issued and controlled from outside the Eurozone to replace the existing payment solutions, a scenario threatening the financial stability of the monetary sovereignty.