Admission will be granted by order of pre-enrolment. Admitted students will be informed in advance so that they may process their official enrolment.

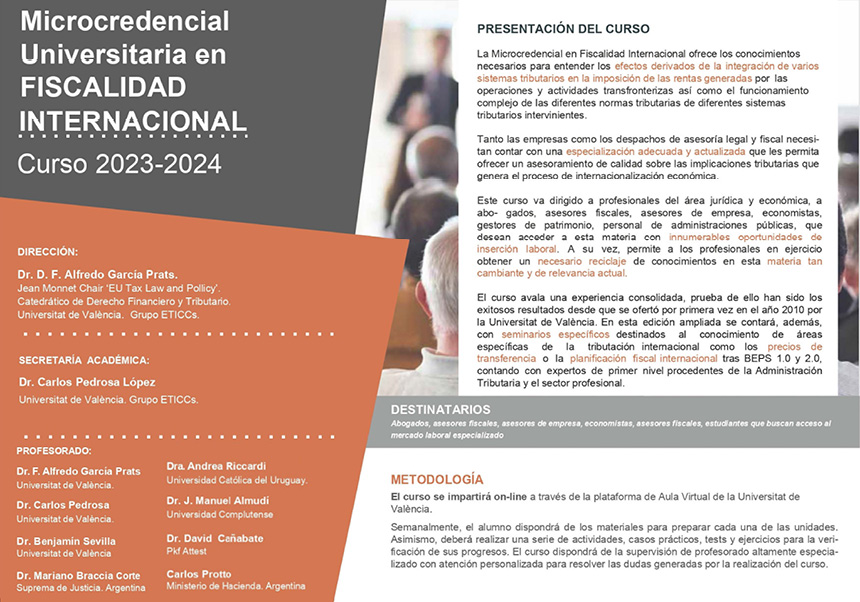

The Micro-credential on International Taxation provides the necessary knowledge to understand the effects derived from integrating multiple tax systems in the collection of earnings generated by cross-border operations and activities as well as the complex functioning of different taxation rules from the multiple participating tax systems.

Both businesses and legal and tax consultancy offices must posses an adequate and up-to-date specialisation in order to provide quality consultancy services on the tax implications generated by economic internationalisation.

This course is designed for professionals in the legal and economic fields, including lawyers, tax and company advisors, economists, asset managers and public administration staff. It offers the opportunity to gain in-depth knowledge of the subject, which is relevant to the acquisition of numerous job opportunities. It provides an opportunity for practising professionals to enhance their understanding of this dynamic and pertinent subject.

The course is well consolidated, as prove the successful results ever since its first offering back in 2010 by the Universitat de València. This extended edition will have, additionally, specific seminars destined to the knowledge in specific international taxation fields such as the transfer prices or the international tax planning after BEPS 1.0 and 2.0, with top of the line experts from the Tax Agency and the professional sector.