Since its inception, the members of the ETICCs Research Group have carried out numerous collaborative activities with other universities, public institutions and consortia.

We believe that strategic alliances lead to joint action, which subsequently allows for new studeis and critical debates, which are an essential part of our work.

We see academic institutions as the focal point of knowledge and free thought. We are committed to the dissemination of this knowledge, particularly in the complex, dynamic and changing field of tax law, whether at the domestic, international, comparative or EU level.

The Research Group works closely with a number of national and international groups and associations, including the following institutions and consortia:

1. GLOBAL TAX SYMPOSIUM

The Global Tax Symposia (GTS) aims to become the first mobile interdisciplinary research platform on fundamental issues of international taxation. It is founded on the belief that integrating the perspectives of Africa, the Americas, Asia and Europe will be of significant benefit to all participants, particularly in light of the current global political and economic context.

The GTS aims to provide a platform for young researchers and experienced academics to engage in discussions on five papers each year in different cities across the globe. Each paper is discussed by an interdisciplinary and intercontinental panel of distinguished academics, administrators, lawmakers and tax professionals.

The founding institutions include:

Africa: University of Pretoria (South Africa); The Americas: Torcuato di Tella University (Argentina), University of São Paulo (Brazil), McGill University (Canada), New York University (USA); Asia: Wuhan University (China), Meiji University (Japan), National Institute of Public Finance and Policy (India), Moscow State University (Russia), King Saud University (Saudi Arabia), Seoul National University (South Korea); Asia–Pacific: University of Melbourne (Australia), University of New South Wales (Sydney, Australia), University of Auckland (New Zealand); Europe: University of Louvain (Belgium), Sorbonne Law School (France), University of Münster (Germany), Leiden University and project funded by ERC GLOBTAXGOV (Netherlands), Stockholm University (Sweden), Koç University (Türkiye) and London School of Economics (United Kingdom).

- 2023 Global Tax Symposium

- 2022 Global Tax Symposium

- 2021 Global Tax Symposium

- 2020 Global Tax Symposium

- 2019 Global Tax Symposium

2. EUCOTAX WINTERCOURSE

The EUCOTAX (European Universities Cooperating on Taxes) programme is an annual international tax law seminar. Its focus is on ‘European harmonisation of tax law', with each yearly seminar addressing a different topic and a wide range of related issues.

The primary objective of the EUCOTAX programme is to promote debate and highly specialised studies among university researchers. The programme also aims to enhance methodological skills by establishing a cohort of young researchers specialised in the analysis of taxation issues from an EU perspective, rather than a narrow national or domestic focus.

The participating universities include: Vienna University of Economics and Business (Austria), Katholieke Universiteit Leuven (Belgium), University of Paris 1 Panthéon-Sorbonne (France), University of Osnabrück (Germany), Eötvös Loránd University (Hungary), Luiss Guido Carli University (Italy), Tilburg University (The Netherlands), University of Lodz (Poland), University of Warsaw (Poland), Universitat de València (Spain), Uppsala University (Sweden), University of St. Gallen (Switzerland) and Georgetown University (USA).

The following topics have been covered in previous editions: Legitimacy of tax rules (Uppsala, 2023), Taxpayers’ rights in the 21st Century (Valencia, 2022), Neutrality and Business taxation in a post Base Erosion and Profit Shifting (BEPS)/ Anti-Tax Avoidance Directive (ATAD)/ Corona world (Uppsala, 2021), Base Erosion and Profit Shifting (Warsaw, 2020), Sustainable Taxation and Developing Countries (Amsterdam, 2019), Challenges to Tax Autonomy in an Era of Conflicting Political Goals (Edinburgh, 2018), Tax Legislation in a Globalized World (Zürich, 2017), Potential Impact of BEPS on Tax Systems (Vienna, 2016), Impact of the Digital Economy Taxation (Barcelona, 2015), Fairness and Taxation (Paris 2014).

3. VALENCIAN COMMUNITY BUSINESS CONFEDERATION (CEV)

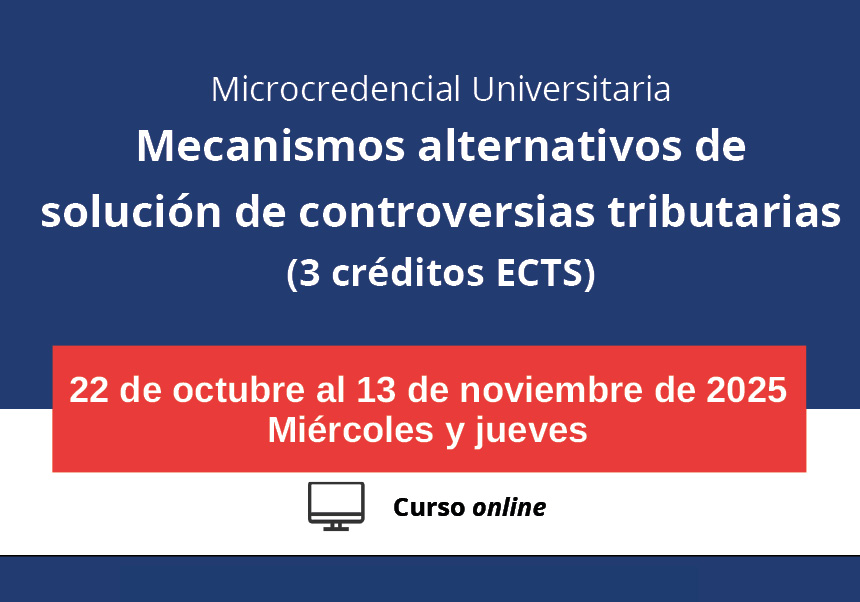

The Universitat de València, through some of the members of the ETICCs group, has entered into a collaboration agreement with the Valencian Community Business Confederation (Confederación Empresearial Valenciana, CEV). This agreement is designed for the implementation of joint activities related to teaching, dissemination and consultancy sessions.

We encourage CEV members to contact us to organise any kind of activity.

4. SPANISH ASSOCIATION OF TAX ADVISORS (AEDAF)

The Universitat de València, through the ETICCs group, has entered into a collaboration agreement with the Spanish Association of Tax Advisors (Asociación Española de Asesores Fiscales, AEDAF). Dr José Luis Bosch, a member of the Group, is the coordinator of the rights and guarantees section of the AEDAF and Professor F. Alfredo García Prats, head of the ETICCs group, is member of the international taxation and transfer pricing section of the AEDAF.

5. PROFESSIONAL ASSOCIATION OF TAX ADVISORS OF THE VALENCIAN COMMUNITY (APAFCV)

The Universitat de València, through some of the members of the ETICCs group, has entered into a collaboration agreement with the Professional Association of Tax Advisors of the Valencian Community (Asociación Profesional de Asesores Fiscales de la Comunidad Valenciana, APAFCV) with the purpose of implementing joint activities related to teaching, dissemination and consultancy sessions.

If you are a member of the APAFCV, we encourage you to contact us to organise any kind of activity.

6. EUROPEAN FISCAL CONFEDERATION – ECJ TASK FORCE

The Head of the ETICCs Group, Professor F. Alfredo García Prats, has been a member of the European Fiscal Confederation's ECJ Task Force since 2014. The ECJ Task Force is made up of renowned experts from different European universities, the European Commission and the business sector.

It regularly analyses the most relevant decisions of the Court of Justice of the European Union regarding direct taxation. The reports are published in the European Taxation journal, the official journal of the ECJ.

7. SCUOLA DI ALTI STUDI TRIBUTARI (SEAST)

Some members of the ETICCs Group actively collaborate with the EUTAX Group and the Scuola di Alti Studi Tributari (SEAST).